Hello 👋

Today I’m sharing the startup story of Claimer, who’ve created a seamless way for UK startups to claim R&D tax relief.

Why is using Claimer better than consultants and accountants?

Easy for you. Plugin the facts. 🔌

Handled with care. Their experts take care of the rest with HMRC. 👔

Bonus. Founder-friendly rate (5% success fee, capped to £10k) 😍

Not sure what R&D tax relief is? I’ll go into that first.

I’m writing this from the perspective of a founder and business owner who has claimed R&D tax credit successfully numerous times, year after year.

I’m not a lawyer, accountant, tax service, or anything like that.

I’ve just had a great experience claiming R&D tax relief and want to share my insight so other business owners can claim back a ton of money from HMRC in the most cost and time-effective manner possible.

If you’re unsure what claiming R&D tax credit means, it’s basically a UK government scheme to reimburse small and medium-sized companies for a portion of their research and development expenditure.

Up to 33%! Big money.

When I first heard about this scheme a few years ago I was skeptical.

From an initial review, we certainly qualified as a company.

The criteria:

🇬🇧 Incorporated in the UK

👥 Staff count less than 500

💶 Turnover lower than €100m

But, I wasn’t sure if our R&D expenditure would qualify.

We developed software, which seemed kind of ordinary. I had this preconception that our R&D department had to be like SpaceX or something.

As it turns out, that really isn’t the case.

The scheme covers a broad range of R&D projects. But, most companies don’t realise they qualify.

Data from HMRC analysed by tax reclaim specialists suggest 80% of eligible companies that qualify have either not claimed or have underclaimed. This amounts to £84 billion in ‘unclaimed R&D relief’ from HRMC. Wow.

So long as your company is attempting to solve technical or scientific uncertainties and is introducing new concepts and ideas, you should qualify.

Our R&D expenditure claim for software development did very much qualify, so we received a healthy payment into our company bank account from HMRC quickly after claiming, and in the years following.

This money had a material impact—we were able to hire more staff.

The scheme is based on corporation tax relief, but, your company does not need to be paying UK corporation tax in order to qualify.

Your business also does not need to be profitable or revenue generating, since many companies conducting R&D have not shipped a commercially viable product yet.

The R&D expenditure you can claim for is also generous.

Such as:

👤 Employees (including contractors and subcontractors)

🌎 Foreign employees, contractors, and subcontractors

🧑💻 External software development

📞 Recruiters

💻 Software

🚰 Utilities

🪵 Materials

💷 Capital expenditure

💳 Trial volunteer payments

Consultancy Firms

I didn’t prepare the R&D claim myself, and neither did anyone at my company. A specialist R&D claim consultancy firm did.

Why? We were in growth mode at the time and I wanted to focus my attention on product and sales.

It’s possible to file your own R&D claim, but there’s a lot of nuances to the process that R&D consultancy firms understand way better — particularly when it comes to determining the exact expenditure you can claim for.

Getting this wrong can result in a big underclaim (leaving a ton of money on the table) or rejection from HMRC. This year, HMRC added 120 new tax inspectors to review the legitimacy of software claims being submitted.

So, we used a specialist R&D consultancy firm and utilized the expertise of their staff to prepare and file our claim.

If you’ve claimed R&D tax relief before, it’s likely you used such a consultancy too. Many startups do. They remove anxiety from the process.

Overall, I had a great experience using the firm.

They were helpful, knowledgeable, and before I knew it HMRC had deposited R&D funds into our company account.

But, it was expensive.

Fees for R&D consultancy firms are usually in the range of 15–20%, and uncapped.

That’s a serious slice.

And, using them did take up a material amount of time—both from myself and my CTO.

There were many meetings and reporting requirements that added up to significant hours. In short, we got interrogated pretty hard.

Why? The work is done ‘manually’ by staff at the consultancy—spreadsheets, emails, calls. It’s all very hands-on.

By the time our claim was filed, I felt like an R&D tax consultant.

Good, but could be much better.

And, that’s exactly what you can get. Much better…

Discovering Claimer

Last year I started a campaign on Twitter to raise awareness of R&D tax relief among UK founders and business owners.

At the time I recommended founders use an R&D claim consultancy I had first-hand experience with and felt comfortable endorsing.

A prominent angel investor replied to one of my tweets with a comment suggesting another service… Claimer.

At first, I thought “Claim-who”?

I had never heard of them.

It turns out there was a good reason. They’re a young startup!

Their ‘TechCrunch launch’ was just a few months prior. 👇

Aware the angel investor is a smart cookie, I checked them out.

After perusing their website for a few minutes, my initial reaction was “wow, this really is a huge upgrade!”.

It just looked better in every meaningful way over legacy R&D claim consultancies.

Faster, easier, cheaper.

Not just marginally, but another level up.

Enough to make virtually any startup currently using a legacy consultancy switch to using Claimer.

How? They’re solving the otherwise hands-on and labor-intensive R&D claiming process with technology.

What previously took ages now takes around 30 minutes, because it’s mostly automated with software.

As a result, they can charge less.

Their fee is just 5%, payable on the successful receipt of funds from HMRC. That’s like a quarter of the amount charged by legacy consultancies.

Plus, Claimer cap your fee at a relatively low amount if you have a huge R&D claim. Consultancies generally don’t.

🧠 The genius part: you still get hands-on expertise where it matters.

Claimer have experienced R&D claim consultants who write and submit your claim report to HMRC once you’re ready, including all communication dealt with.

This expert touch means you can sleep a lot more soundly knowing your claim is defensible, reliable, and optimum.

After all, no one wants their claim rejected, challenged, or to have ‘left money on the table’ when it’s easily avoidable.

Market Research

Before writing this I wanted to improve my knowledge of the R&D claim marketplace, speak with Claimer customers, and generally get to know the company a little better.

So, I spent some of my ‘downtime’ over a few weeks talking to founders about their experience claiming R&D tax relief.

To figure out if using Claimer is optimum amongst the options available, I mapped out the approaches startups currently use to claim R&D relief.

Here they are:

👔 Consultancies: My research revealed that most startups use R&D claim consultancies. The reviews were mixed—happy, adequate, or (in some cases) hatred!

For those that were dissatisfied with their R&D claim consultancy, I probed to find out why. Mainly, it was “wasting time”. The back-and-forth to process the claim just took too long.

For those that were happy, they were like me before I discovered Claimer—elated to receive the R&D funds and ‘grateful’ to have a consultancy on board to head up what can be an anxiety-inducing process.

In other words, using a consultancy reduces cognitive load and increases the perception the submitted claim is value size optimal and won’t be rejected.

Claimer achieves this, but much faster and at a significantly reduced cost.

✅ Claimer wins here on time and price.

🔢 Accountants: A less common approach, though still prevalent, is using accountants to file R&D claims.

The reasoning for this approach seems to be tied heavily to convenience—‘our accountant can do it’.

Whilst this isn’t exactly crazy logic, it’s also not necessarily optimum. R&D claims aren’t accountants’ bread and butter, so that generalist touch comes with risks.

Conversely, companies that handle R&D claims every day and understand the nuances of the process are in a much better position to 1) submit a defensible and reliable claim, and 2) claim the largest amount possible.

Fees charged by accountants for this service varied wildly, from 5-15%. And, so did the amount of time required from founders to produce a claim — from low to high input (many hours).

✅ Claimer wins here on claim reliability and claim value, plus time and price on most occasions.

🖌️ DIY: A handful of founders/operators I spoke to prepare and submit their own R&D claims. That’s rock n’ roll, I like it!

The clear advantage of this approach is zero fees.

But, there are some catches:

Time: learning the nuances of the claiming process, preparing the claim, submitting the claim, and dealing with HMRC.

Defensibility & reliability: knowing how to prepare and submit a claim that won’t get rejected or later challenged.

Value: fully understanding what types of expenditure qualify for R&D relief so money isn’t left on the table.

✅ Claimer wins here on claim reliability, value maximisation, and time.

⚙️ Automated Solutions: It turns out there are a few solutions in the marketplace that have introduced software and thus automation to the R&D claim process.

Besides Claimer, there’s RDVault and EmpowerRD as examples.

On the surface, they’re pretty similar:

Fast process (hours or less).

Low fees (5% or less).

Automated (connect accounting software).

“100% success” claims, no reductions by HMRC.

Frankly, all of them are better than using a legacy consultancy.

To understand why Claimer thinks it’s the best of the bunch, I reached out to their CEO for his take.

Speaking with the CEO

Meet Adam McCann, CEO and Founder of Claimer. 👇

Adam said:

Our biggest differentiator is actually that we are a genuine tech company (the only one in the space) trying to fix the process.

I'm a technical CEO and we are entirely product-led. We're working on innovations that we think will turn the industry upside down (what we have so far is great, but we want 10x).”

And yes, this involves lots of R&D cost that we should really claim back at some point 😉

This sounds exciting. Adam, you had me at “genuine tech company”.

I have visions of GPT-3 enabled Claimer bots preparing my R&D claim and communicating with HMRC. 🤖

It’s obvious a ton of effort has gone into developing the product technically.

Automating R&D claims is not an easy problem to figure out. For an early version, brainstorming how to structure optimal user flows and handle complex edge cases went on for months.

If you want proof, check out their mega whiteboard from this time! 👇

So where did the idea for Claimer come from?

A common entrepreneurial path—experience a friction point and want to change it.

Adam previously had a less than optimum experience with an R&D consultancy while running a tech-focussed media company. This included wasted time, high fees, multi-year contracts, and shady practices. Basically, a massive unnecessary headache.

Once the media company was sold, Adam wanted a fresh challenge and jumped on the opportunity of solving this pain point for founders.

Adam said:

I literally built the current version of Claimer as an MVP after walking into a local co-working space and validating the problem. We got some organic traction, raised the pre-seed in Q4 2019, and it's since been retrofitted into an end-to-end product.

It illustrates how broken the industry is that our super limited MVP grew 6x in 2020, without spending a penny on marketing.

Notable investors agree and have so far put £300,000 into the company (with more on the way).

He reports Claimer has grown from zero to hundreds of customers quickly—and entirely through referrals and word of mouth. Though that is not through choice, they’ve just been too “run off their feet” to run marketing campaigns.

I expect this will change once their latest funding round has officially closed.

After questioning the marketing copy on Claimer’s website, Adam came back with some interesting insights into their ideal customer profile and market positioning:

The aim is to strike a balance between a traditional advisor and a SaaS company (which we need to ensure we're hitting, not sure atm!).

Whilst price is important, it is only a side effect of the key unique selling point which is efficiency/reduced hassle at the moment.

Our target persona is chiefly interested in producing a defensible and reliable claim than they are the lowest price in the market.

My goal is for people to see the benefits of using Claimer from a product/service point of view, almost assume it's going to be a hefty price due to how awesome it looks, then discover it's actually incredibly reasonable (icing on the cake).

What next?

Adam reports a huge upgrade is right around the corner.

We've got Claimer v2 coming up. We're working on innovations that we think will turn the industry upside down.

It’s the result of about a year's intense work led by our CTO (Andrew Easter - ex Chief Platform Architect at eBay) and our engineering team.

They've taken the learnings from the MVP and built a sophisticated form engine that powers the application and will enable us to iterate quickly, scaling in the UK and abroad.

At launch it will handle what Claimer v1 does today, but at scale with a vastly improved UX. More importantly, unlike v1, it will provide a foundation that allows us to rapidly iterate and build the product out.

I asked Adam about his vision for the business since I get the feeling R&D claims is just the beginning.

Claimer’s name is not restricted to R&D and could be used for any government claims process, which I interpreted as a clue to future intentions.

This is what he said:

We believe that discovering and applying for government incentives should be quick and easy.

Claimer is the interface between SMEs and government incentives. Our goal is to matchmake businesses with these incentives and provide a hassle-free way to claim them. Our first product makes claiming UK R&D tax credits a breeze.

Startup after startup has to travel the well worn path of doing a load of admin/compliance crap, instead of doing the work that actually adds value and grows the company - building the team, iterating on the product/service, talking to customers etc.

It should not be like this.

I developed the Claimer v1 app solo as a sort of way to bootstrap the idea - getting initial traction/revenue quickly before going back 'upstream' into the bigger idea to kick it off.

A ton of opportunity. Exciting.

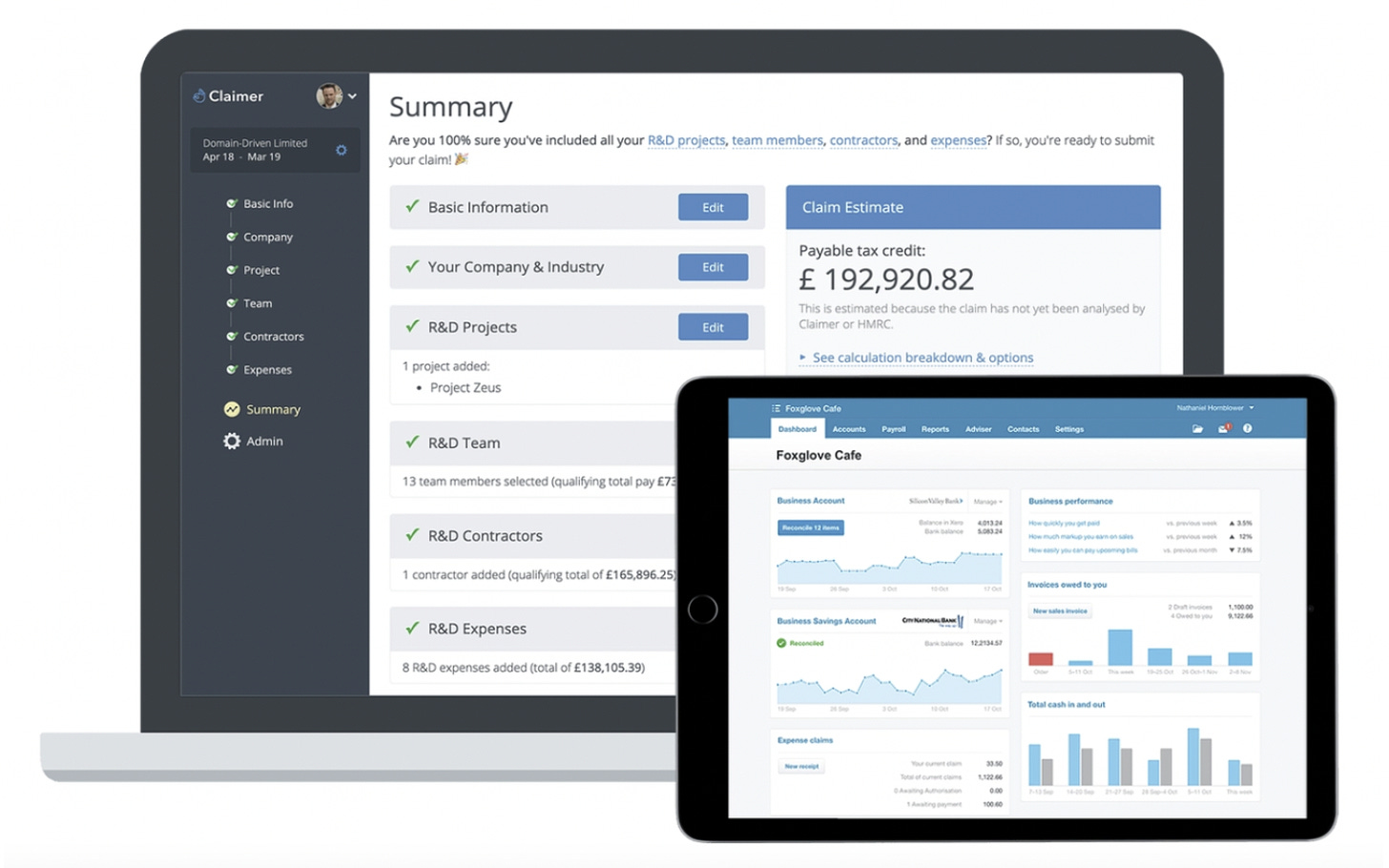

How does Claimer work?

In a nutshell:

➡️ Head on over to their website.

🔗 Connect your accounting software.

💻 Add your details in a super slick dashboard:

🧐 Submit your application to a Claimer R&D expert—they’ll review and submit it to HMRC.

💷 A few weeks later, get paid.

So far, they’ve processed claims for over 300 UK startups.

Here’s what their customers say publicly:

Thomas Evans, EmailOctopus:

“Used Claimer for the past couple of years after originally giving another consultant the industry average of 20%. Our experience has been the following:

We're only paying 5% per claim now.

Our claim is better written and put together.

We've had zero issues or queries from HMRC on the claim.

They worked with us closely to identify some further expenditure we weren't previously claiming for.

Can't recommend Claimer more. We've claimed back tens of thousands in tax research and development expenditure, and kept much more of money.”

Lewis Hemens, Dataform:

“We used Claimer to do our 19/20 claim recently.

It was an absolute breeze and was all turned around in a few weeks - I've done the typical consulting route before, and had deliberately been putting off doing our claim because I thought it would be painful. I was wrong!

As a CTO in a Seed/Series A stage startup this was a godsend, and we got the perfect balance of a simple online self-service process with just the right amount of human, professional help when we needed it.”

Saher Shodhan, Traktion.ai:

“Claimer is amazing! We used them last year and everything from the onboarding, to the support, was fantastic.

It took us less than 30 mins of work to get back £15,000!

I also received similar feedback in private conversations with other founders.

If you’re looking to claim R&D relief for the first time or want to switch over from using a consultancy or accountant, use this link to file your first claim with Claimer.

Until next time!

Martin 👋

To receive more newsletters like this, subscribe below. 👇