How I 'Sanity Check' Financials For a B2C Business Idea

A 'back of the napkin' evaluation that can save a ton of time and money.

Hello 👋

Martin here. Welcome to another edition of Founders’ Hustle!

I produce content about the “hustle” of entrepreneurship and building startups.

Today I’m sharing how I ‘sanity check’ financials for new B2C ideas.

It’s not perfect but generally filters out troublesome business models. ✅

Doing this led me to cancel projects before investing in them. 💸

One was hard to let go of emotionally, but it was for the best! 🍺

One of the first things I do after ‘stumbling across’ a new B2C business idea is to run some ‘back of the envelope’ calculations to get a sense of whether or not it has a realistic path for growth and profitability.

Doing this has led me to shelving a lot of ideas before investing materially in them.

One was a concept called Beer Butler 🍺

Basically, an online beer subscription service. It didn’t get passed a logo.

The margins were much thinner than wine and the overall unit economics were just a bit too tight to be comfortable, so I gave it a pass. Which, was kind of sad to me since I was emotionally invested in it. 😢

Other companies have pursued the same model since then, with no real breakout successes thus far. So, I think I made the right call.

At the idea phase, it can feel futile to start modelling financials. There are a lot of unknowns, so projections rarely materialise in reality.

Frankly, this is something I agree with.

Forecasting exact figures over a period of years and attempting to draw meaning from them is largely fruitless — it creates an arbitrary financial roadmap.

But, this is not the objective here. What I’m interested in at this point is ‘tolerances’.

KPI tolerances, that is. 🔑

It boils down to a simple question.

How much bandwidth is there for KPIs to move ‘unfavourably’ and the business remain theoretically profitable and able to grow?

The more flexible this range, the greater the chances of success.

If you have to hit within a narrow KPI range in order to be successful, the ‘target’ you are aiming at is super small. Think of it as a tiny dartboard. 🎯

Whereas, if there is a lot of manoeuvrability in those numbers, it’s a big dartboard — and so is the bullseye.

It can also be an indicator of other insights, too.

A tight, high bar, KPI tolerance range can be symptomatic of an oversaturated market, whilst a broad KPI tolerance range can be symptomatic of a ‘blue ocean’ opportunity.

This is because the barriers to entry are higher with competitive markets.

Hypothetically, let’s consider a B2C software app that grows primarily through paid acquisition (digital advertising) as an example.

In this hypothetical scenario, it has a ‘freemium’ model wherein the basic functionality is free but heavier usage customers have to pay via subscription.

It’s not a marketplace or a service that gets better with more users, so the only ‘real’ value a customer provides to the business is revenue.

There’s three immediate KPIs that are important to contemplate:

🎣 Customer Acquisition Cost: How much it costs to acquire customers.

📈 Conversion Rate: What % of customers convert into paying customers.

🤑 Paying Customer Value: How much value paying customers generate in revenue.

This can seem a little abstract to consider without any data, but, it’s possible to inject a sense of reality by using a framework.

By researching the “closest” competitors to the idea or components of the business model in question, and getting a feel for their KPIs, there’s an initial baseline to work with.

At this point, I can whirl up a basic spreadsheet and start to populate it.

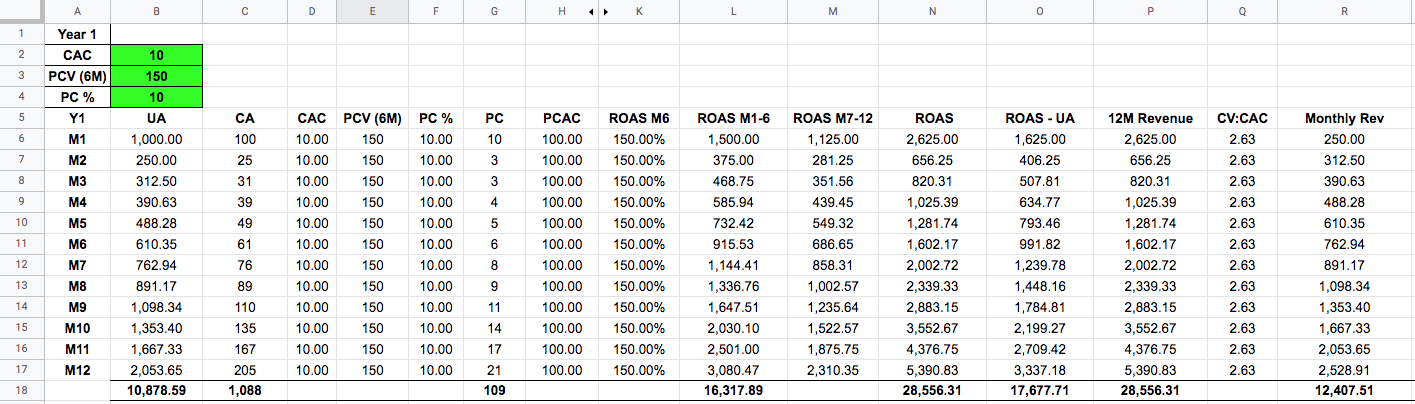

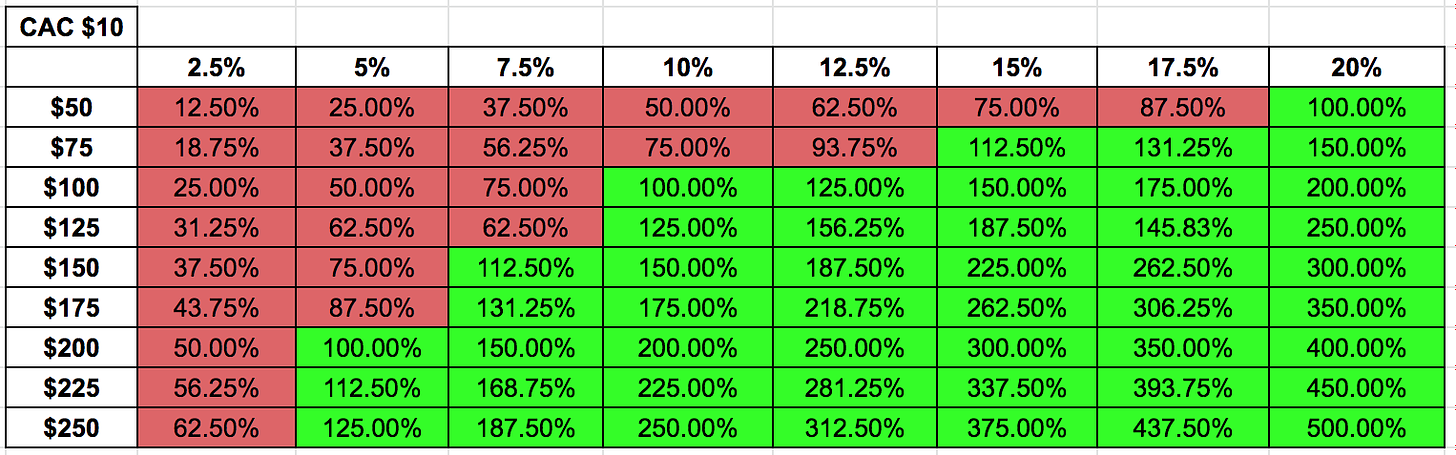

In the top left, in green, I have the major KPI variables. Changing these affects the rest of the spreadsheet. My ‘research’ returned these figures:

CAC: $10

CR: 10%

PCV (6M)*: $150

*I drop off revenue in months 7–12 to roughly account for churn.

So, once input these figures, it populates the other cells with data.

In the example above, I started off by spending $1,000 in advertising in Month 1 as a one-off injection of capital, and reinvested the returns through to Month 12.

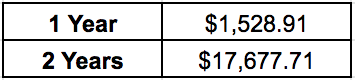

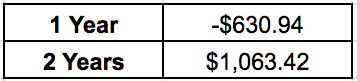

This generated “gross profit” for the year of $1,528.91, and $17,677.71 over two years, which can be used to fund operating expenditure:

But, all we have here is a baseline. Now, it’s time to probe further by ‘playing around’ with the KPIs using a logical basis. This is unique in each circumstance, so I try to calibrate them realistically and with merit. Otherwise, the process falls apart.

For example, if I’m able to offer my product in a market that is untapped by competitors, I could make the assumption CAC will be lower at varying degrees and explore how that changes the financials.

If my product delivers more value to the customer than the competition, I could make the assumption PCV (6M) will be higher in varying degrees and explore how that changes the financials. This is where a unique value proposition can really shine through.

The reverse is also true — catering for the ‘unknown’ and factors that are ‘overlooked’ or ‘underestimated’.

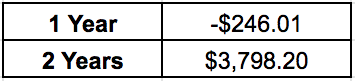

What happens if CAC is doubled — $20?

What happens if the Conversion Rate is halved — 5%?

What happens if PCV (6M) is 50% less — $100?

Doing this helps me build ‘quick narratives’ around the business model. Not just by changing numbers randomly, but by deliberately adjusting them depending upon what I believe to be the strengths and weaknesses of the business in that unique context.

It’s possible to ‘get a feel’ for what KPIs are most likely to deviate based upon the research, and to roughly what degree. This can be used to map out a minimum and maximum threshold for each KPI.

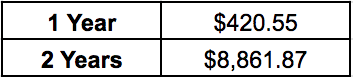

You can also use a sensitivity analysis chart to consume this data better visually, where Conversion Rate is on the x-axis and PCV is on the y-axis:

In the above example, the KPI range where a business can hit and ‘win’ (green) is larger than the red area (where it ‘loses’).

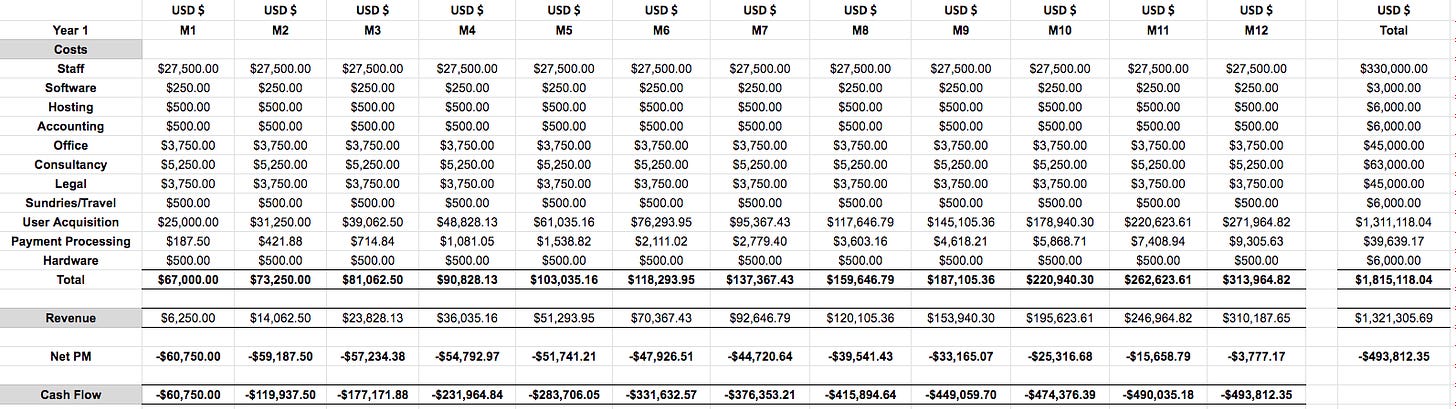

Once I’ve played around with the basic unit economics, I can now tie this back to a crude P&L sheet to see how the overall picture looks.

First, I map out ‘known’ costs — those that are fairly predictable.

Examples are staff, software licenses, hosting, etc. It’s relatively easy to quantify what inputs are needed to get a product ‘off the ground’ in the beginning.

But, what if I wanted to grow faster? 🚀

Going from $250 revenue in Month 1 to $2,500 in Month 12 is a 10X increase, but it’s not an overall large amount and creates other problems.

So, let’s assume I want to spend a fixed amount of $25,000 per month on paid advertising and reinvest all revenue accrued from customers back into advertising — so it compounds.

I update my sheet accordingly:

And, this feeds through to the P&L on sheet 2 (in the link):

This gives a feel for if both the unit economics and underlying operating expenditure requirements support the argument for building a profitable business.

Again, ‘playing around’ with the KPIs on the first sheet gives more visibility here. It also provides an indication on whether or not external capital will need to be raised, and, a range of how much.

In the exact example above, the business is on the path to profitability but there is a minimum fundraising requirement of $500,000 for Year 1.

Usually, I’ll test KPI tolerances across a five year period to ‘get a feel’ for how they hold up as the business scales — roughly factoring in the effects of growth like economies of scale and the laws of diminishing user acquisition ROI.

If the results look promising the next step I’d usually do is further refine the KPI data by testing a mock-up, MVP, or ‘mechanical turk’ type experience with real potential customers to get real indicative figures.

I can then plug the results back into my model to see how it shapes up.

⚠️ Disclaimer: There are a lot of assumptions being made with this approach and it is far from conclusive.

For example, it doesn't address navigating to product-market fit, total addressable market, customer behaviour, retention, other growth or go-to-market strategies, etc.

It also doesn’t work with product ideas that have to clear route to monetization. Lots of stuff.

Plus, the inputs will need to change considerably depending upon the business model idea in question. For example, selling physical products adds costs on a per-unit basis.

This is not reflected above at all. So, it needs to be adjusted accordingly.

But, I find this quick ‘sanity check’ helpful to filter out ideas at the very earliest stages that are totally unviable or have a narrow pathway to success.

Until next time!

Martin 👋

Not subscribed to this newsletter? Let’s fix that right now 😉👇